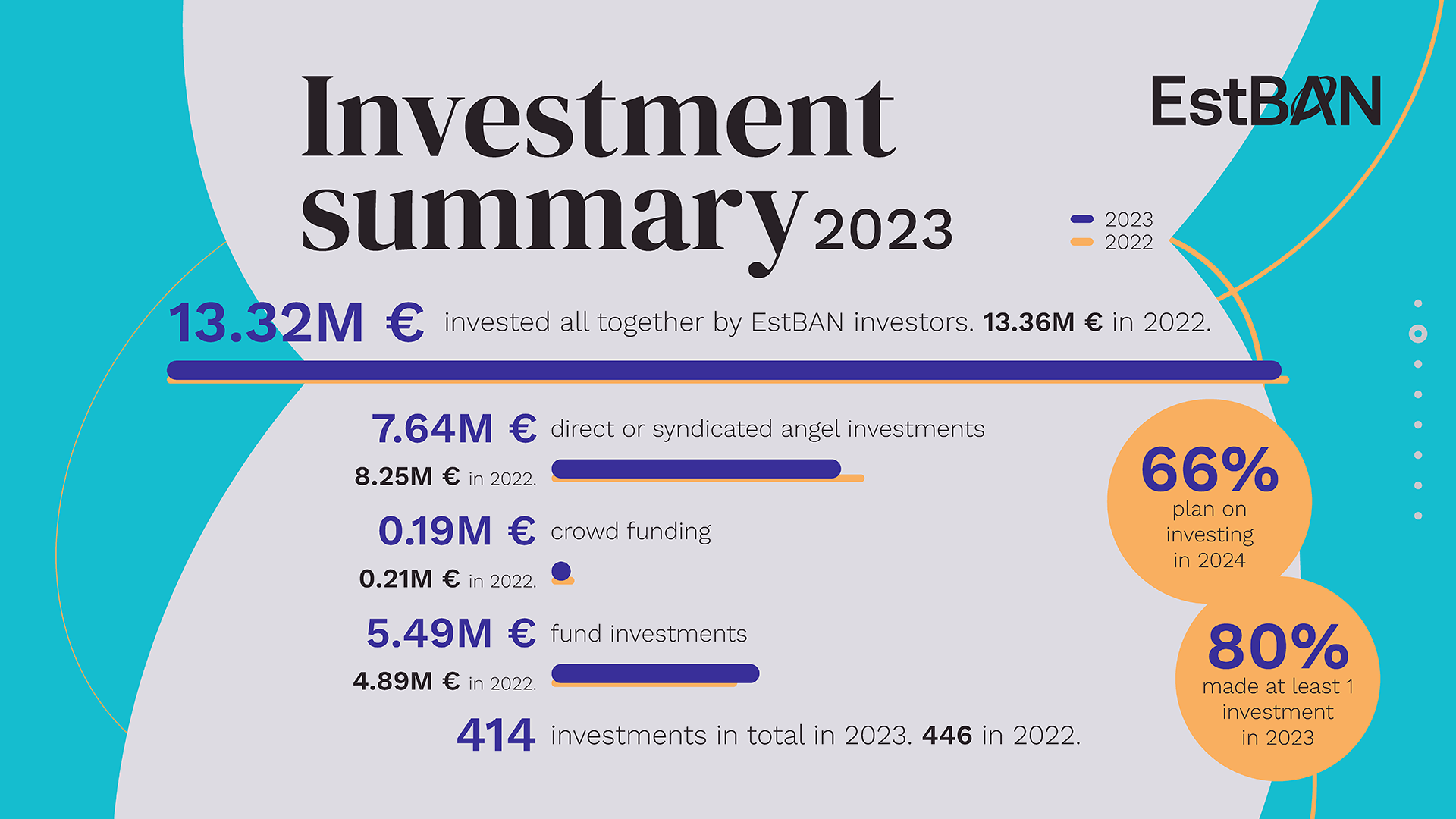

The investments made by the members of EstBAN in 2023 remained at the same level as reported in 2022 when €13.36 million was invested into startups. The proportions of investments from the previous year also remained similar: €7.64 million were angel investments, €5.49 million were fund investments, and €0.19 million were invested through crowdfunding platforms.

Once a year, the Estonian Business Angels Network conducts a survey among its members, asking investors to share their investments made during the year. By the end of 2023, the network consisted of 306 members, of which 279 were private investors and 27 were members of venture capital funds. There were 34 new members to join last year. Nine percent of the investors are women. 128 investors (42% of members) responded to last year’s survey, of which 80% indicated that they made at least one investment in 2023, and 92% believed that they would continue investing in startups this year.

Lauri Antalainen, President of EstBAN, noted his satisfaction with the continued activity of business angels and the consistent investment volumes despite the ongoing war in Ukraine and the current economic situation worldwide.

“The stable level and consistency of angel investments are critically important for startups because in ten years, new unicorns (such as Bolt, Wise, and Pipedrive today) are those that are raising money from risk investors today. I am also very pleased with EstBAN’s syndicates and the emergence of new lead investors,” said Antalainen.

Most of EstBAN’s members are local entrepreneurs, but 13% are foreign investors. Last year, members made a total of 414 transactions, with 75% into Estonian startups and 14% in neighbouring countries. Smaller amount of investments were made into UK, European, or North American companies. 37% percent of members prefer to invest through syndicates, meaning they pool funds collectively under the leadership of experienced lead investors.

The reward for investors is exiting a company. Last year, investors reported 22 exits, with many mentioning returns of two to five times the invested capital. While some did not earn any returns, others reported 10x earnings. EstBAN’s board selected the syndicate assembled by EstBAN investors in 2017 for GuestJoy‘s accommodation software company as the exit of the year, acquired by Australian hotel technology giant SiteMinder.

The most popular sectors for investment, similar to last year, were financial technology companies, followed by business and personnel software, deep and space tech, and health and biotechnology-focused ventures – all receiving investments from at least 10% of investors. The majority of angel investors prefer to invest €5,000 to €20,000 in a single deal.

Angel investors mentioned a total of 120 different startups they invested in during 2023. The most mentioned companies included Paul-Tech, Cino, Flowstep, Lightcode Photonics, Nanordica Medical, Cuploop, Efenco, Salv, EyeVi Technologies, Complok, Gearbox Biosciences, and Machineric Solutions.

This spring, EstBAN, together with the European Business Angels Network, will organize the European Business Angels Network annual meeting, which will take place from May 20th to 22nd in Tallinn’s Noblessner Quarters.

- Click here for in-depth EstBAN Annual Report 2023

- Click here for in-depth EstBAN Annual Report of 2022