Thursday, June 13th, EstBAN held a New Member Onboarding Session for angel investors who have joined EstBAN within last couple of years and those who wanted to refresh their knowledge when doing high risk investments. During the first half of 2024 12 new members have joined Estonian Business Angel Network. During 2023 there were 30 new members altogether.

EstBAN board member and lead investor Jan Lätt talked about his journey as an investor and gave great insight of how he is thinking when deciding when and where to invest, when to exit and what to pay attention to.

Some ideas from Jan:

- there are ups and downs and you must be ready to loose;

- single investments don’t work – you need a portfolio;

- syndicates offer more value than investing alone;

- foo fast vs too slow – don’t rush, you will make mistakes and loose money;

- total value of angel investments – 3-5% from total assets/portfolio;

- it’s wise to invest ca 3 startups per year, totally 15-20 investments. Timeline 4-5 years (all this is may vary due to personal preferences);

- think what’s your focus? possibilities: Saas, Fintech, Green Energy…;

- out of 10 startup investments – only a very few might survive and bring back something.

Should I hire a lawyer to do angel investments?

After Jan Lätt’s real life experience on angel invsting, Sandra Toots, Attorney-at-Law in KPMG Law spoke about Legal ABCs for Angel Investors. We learned that investing into a startup requires more than just a gut feeling or a tip from a friend. There’s several legal matters you need to make yourself acquainted with.

Key picks from Sandra’s presentation:

- Which startup to invest into?

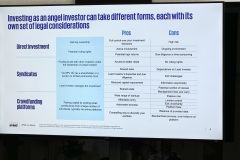

- Which format: direct, syndicate or crowdfunding platforms?

- As a private person (füüsiline isik) or holding company (OÜ)?

- Which type of investments to make? – equity, convertible loan, simple agreement for future equity?

- When you have decided which format you invest, you also need to know the legal documents that are needed for each type of investment, be it direct, syndicate or platform.

Terms in the investment agreements to know:

- Equity investment -> direct ownership.

- Convertible loan -> debts that converts into equity under certain conditions (konverteeritav laen). instead of receiving your loan back with interest, investor receives equity in the company.

- SAFE: agreement for future equity under specific conditions.

- Term sheet: is non-binding agreement.

- Cap table: capital structure before and after the investment.

We hope evereyone who was there, gained something interestin and had an overall good time! Educated investors are EstBAN’s mission! EstBAN holds New Member Onboarding Sessions twice a year and it’s mostly meant for novice business angels but the whole network is welcome to refresh the knowledge and eduate themselves.

Should you need more legal advice, please turn to our partner KPMG. Find EstBAN other partners HERE.