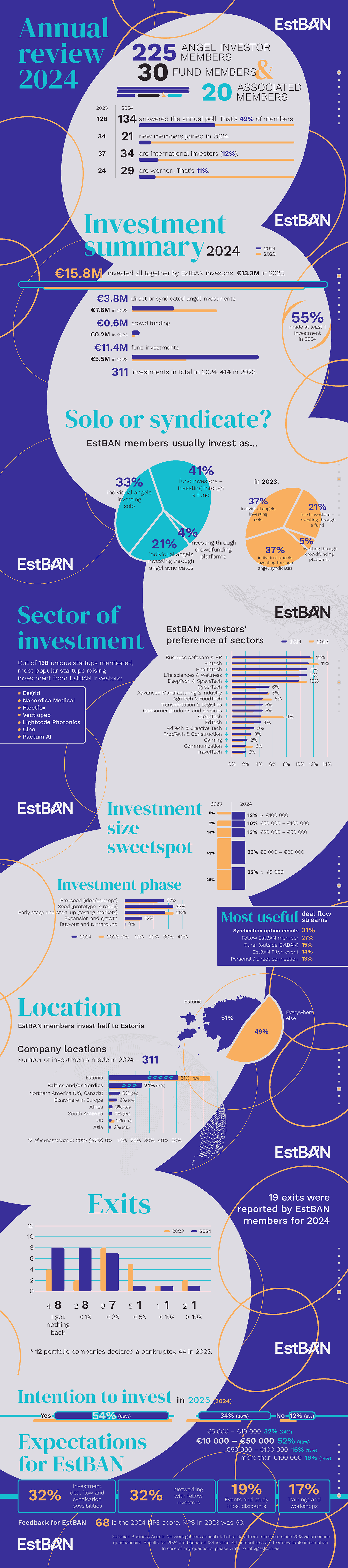

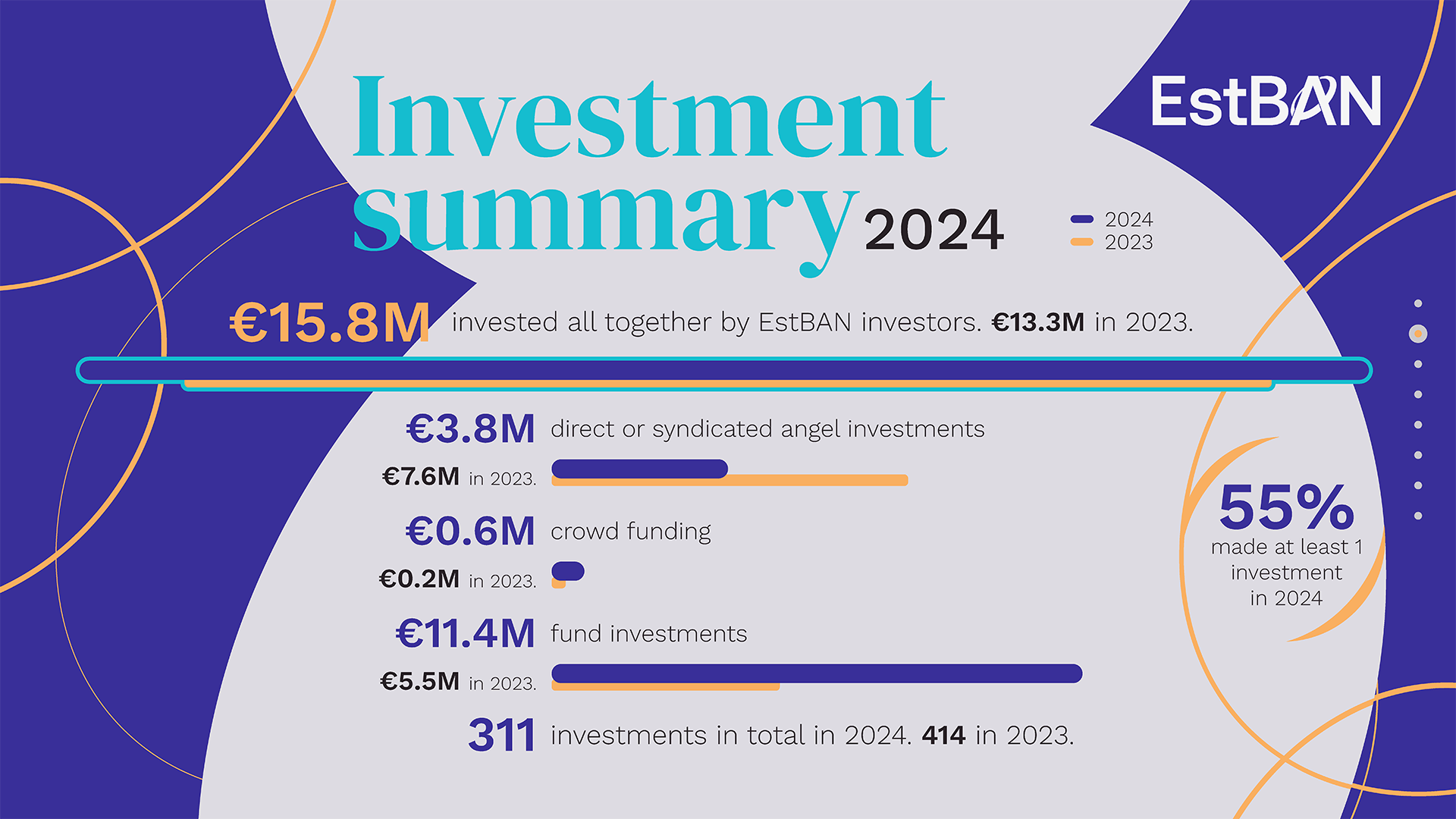

Members of the Estonian Business Angels Network (EstBAN) invested a total of €15.8 million into startups in 2024. That’s more than €2 million more than the previous year, when the figure stood at €13.32 million. Of that amount, €3.8 million were direct angel investments, €11.4 million were made through investment funds, and €0.6 million went through the crowdfunding platforms.

Each year, EstBAN conducts a survey among its members to collect insights into their investment activity. As of the end of 2024, EstBAN had 255 members, including both private individuals and VC funds. A total of 134 members (49%) responded to the survey, with more than half saying they made at least one investment during the year. The majority also indicated they plan to continue investing in startups in 2025.

More investing, smarter strategies

EstBAN President Lauri Antalainen noted that the investment landscape in 2023 and 2024 has been somewhat similar. “Compared to the 2021 investment boom, the numbers are smaller, but that’s understandable considering the global context. I’m glad to see the total amount invested has still increased year over year. We also see a growing trend where investors prefer to invest via EstBAN syndicates – meaning – in collaboration with others. This shows increasing awareness and maturity among investors,” he said. He also highlighted already a milestone from this ongoing year – the first exit from an EstBAN syndicate investment, as startup Adact was acquired.

Supporting new startups after a challenging year

EstBAN’s Managing Director Karin Künnapas emphasized that the more choices investors have, the more effective they can be. “Since a record number of startups shut down last year, we now need to focus on supporting the next wave founders with innovative ideas, global potential, and strong teams. I’m glad to see our investors actively attending events, listening to pitches, and seeking out startups to support, whether for the first time or as follow-up investments,” she said.

She also noted that compared to 3-4 years ago, investors have become more selective. Decisions take longer, and fewer startups receive funding. While 414 deals were reported in 2023, the number dropped to 311 in 2024. There has also been a clear shift in investment geography: whereas 75% of respondents previously focused primarily on Estonian startups, only 51% did so in 2024. 24% of funding went to nearby countries, with noticeable growth in investments into Nordic and Baltic startups, and some capital flowing to North America and other parts of Europe. One of EstBAN’s goals is to encourage cross-border investing, which brings broader experience and better-quality deal flow.

Where the money went?

The most popular sectors remained consistent with previous years: business and HR software, fintech, health tech, biotech, deeptech, and space-related technologies. Looking ahead, EstBAN predicts growing interest in defense-tech startups.

In total, investors named 158 different startups they had backed in 2024 (up from 120 in 2023). Among the most frequently mentioned were Esgrid, Nanordica Medical, Fleetfox, Vectiopep, Lightcode Photonics, Cino, and Pactum AI, most of which have received support via EstBAN syndicates.

Angel investing is, by nature, high-risk. The 2024 results show both sides of the coin: some investors exited with no return, while others saw 10x returns or more on their investments.

EstBAN continues to collaborate with key ecosystem players, including Sparkup Tartu Science Park, Estonian Cleantech Association, EIS, Tehnopol, Workland, Swedbank, KPMG, Hedman Law, and Beamline Accelerator. The network also works closely with international angel networks in Finland, Latvia, Lithuania, Poland, and Slovenia, as well as numerous VC funds in Estonia and abroad.

🔗 View EstBAN results 2016-2023

🔗 Explore EstBAN syndicates